v-y.site Learn

Learn

Average Cost To Have A Deck Stain

The basic cost to Refinish a Deck is $ - $ per square foot in April , but can vary significantly with site conditions and options. Wood stain prices greatly vary. Some clear waterproofing stains are relatively cheap while others semi-transparent stains available in different colors are more. It costs about $2 to $5 per v-y.site to stain a deck, including light sanding and sealing. Since decks come in so many sizes, it is important to know the square. The average cost to stain a deck starts at about $ per square foot for DIY and up to $ per square foot when hiring a pro. Restaining a deck costs. Deck Labor, Hours, $ ; Deck Job Materials and Supplies, Square Feet, $ ; Totals - Cost to Stain Decks - Square Feet, $ ; Average Cost. After taking all of the factors into consideration, the average cost to refinish a deck is $, according to HomeAdvisor. The lower end of that scale is $ The average cost to stain and seal a deck ranges from $ to $1, Deck staining costs are influenced by the quality of stain, labor costs, treatment needs. The average price for 1 Gallon Exterior Wood Stains ranges from $10 to $ Related Searches. outdoor wood stain and sealer. The labor costs are, on average, between $ and $4 per square foot. However, deck staining professionals or painters have their own rates. Get ready to enjoy. The basic cost to Refinish a Deck is $ - $ per square foot in April , but can vary significantly with site conditions and options. Wood stain prices greatly vary. Some clear waterproofing stains are relatively cheap while others semi-transparent stains available in different colors are more. It costs about $2 to $5 per v-y.site to stain a deck, including light sanding and sealing. Since decks come in so many sizes, it is important to know the square. The average cost to stain a deck starts at about $ per square foot for DIY and up to $ per square foot when hiring a pro. Restaining a deck costs. Deck Labor, Hours, $ ; Deck Job Materials and Supplies, Square Feet, $ ; Totals - Cost to Stain Decks - Square Feet, $ ; Average Cost. After taking all of the factors into consideration, the average cost to refinish a deck is $, according to HomeAdvisor. The lower end of that scale is $ The average cost to stain and seal a deck ranges from $ to $1, Deck staining costs are influenced by the quality of stain, labor costs, treatment needs. The average price for 1 Gallon Exterior Wood Stains ranges from $10 to $ Related Searches. outdoor wood stain and sealer. The labor costs are, on average, between $ and $4 per square foot. However, deck staining professionals or painters have their own rates. Get ready to enjoy.

Home and Garden > · Staining a Deck. Staining a Deck Cost. How Much Does Staining a Deck Cost? low cost, Do-it-yourself: $$ average cost, Basic Pro Clean-. DEFY Wood Stain: $40–$55 per gallon. Offers a line of stains and cleaners designed for durability. Sherwin-Williams: $20–$50 per gallon. Durability claims have. How much sealing a deck should cost. Average costs and comments from We Stain Decks[3] in Ohio estimates costs of $ to clean and stain a 10'x When combined with wood deck refinishing (staining or sealing), the total cost is typically $–1,, or $– per square foot. Labor costs make up. The typical price to stain a deck is between $3 and $5 for each square foot. For a modest deck that's around square feet, staining will run you $ to. How much does it cost to have someone stain your deck? Average cost to stain a deck is about $ ( v-y.site). Find here detailed information about deck staining costs. How much does deck staining and painting cost? Prices for deck painting and staining run about $2-$5 per square foot, depending on the size and condition of. As a reference point, deck staining (or painting) a 24×24 deck with high-end material can cost as much as $3k. Let's look at more averages for deck painting. The average deck size in the US is between and square feet. So you may have to buy two gallons, which may cost nearly $ The total cost of the entire. With the average staining job taking up to 20 hours for larger decks, labor often takes up $ of the total project cost. The type of stain you choose for your. Home and Garden > · Staining a Deck. Staining a Deck Cost. How Much Does Staining a Deck Cost? low cost, Do-it-yourself: $$ average cost, Basic Pro Clean-. 2nd Story Standard Deck ; Wash and Stain, 1 Coat Oil Semi Trans, $, ; Sand and Stain, 1 Coat Oil Semi Trans, $1,, ; Strip, Brighten, Wash, Sand and. How much does it cost to stain a deck? Staining a deck has a lot of varying factors. On average, you can expect to pay between $ and $1, to stain a deck. The type of stain used is another factor that will affect the cost of deck staining. Different types of stains offer varying levels of protection and can range. How Much Does It Cost to Pressure Wash a Deck Stain The bundling of pressure washing and deck staining is a shrewd choice many homeowners make, offering. Pressure Treated Deck. The average cost of a pressure-treated wood deck is $10 to $40 per square foot including installation. In the United States, pressure-. Keep in mind that the recommendations below are estimates. Stain Calculator for Decks. Enter your deck measurements below to calculate how much stain. have an affect on the below pricing. Decks- Staining the Floor, Spindles, Railings and Stairs. The below deck staining prices Average Sized Log Homes.

Non Chexsystems Banks In Michigan

If you're ready to put your past beyond you, check out these “Non-ChexSystems Banks”. Michigan State University Federal Credit Union: Rebuild Checking. No balance requirement or overdraft fees. Key Benefits: Check cashing and deposits. Immediate access to your money. These “No ChexSystems Banks” offer all the services you need with surprisingly high acceptance rates. v-y.site has helped thousands of people find. No fees on overdraft plans3; No overdraft charged on a first occurrence each year with Citizens Fee Relief™. Monthly Maintenance Fee. $ or $; Waive the. How Do I Dispute an Account on My ChexSystems Report - Michigan Credit Reporting Lawyer. banks who have ruined your credit. How We Can Help You. No. Banks that offer Second Chance Checking will generally check ChexSystems. in Mechanical Engineering from the University of Michigan, and an MBA from the. Through the Michigan Open Account Coalition, participating banks and credit unions are offering certified low- or no-cost accounts to help Michiganders get. Have you been denied a bank account? LetMeBank provides extensive lists of banks that offer Non-ChexSystems & Second Chance checking accounts across the. Free List of Non ChexSystems Banks ; First State Bank, Michigan, v-y.site ; First State Bank, Kansas, v-y.site ; First State Bank of Mendota, Illinois. If you're ready to put your past beyond you, check out these “Non-ChexSystems Banks”. Michigan State University Federal Credit Union: Rebuild Checking. No balance requirement or overdraft fees. Key Benefits: Check cashing and deposits. Immediate access to your money. These “No ChexSystems Banks” offer all the services you need with surprisingly high acceptance rates. v-y.site has helped thousands of people find. No fees on overdraft plans3; No overdraft charged on a first occurrence each year with Citizens Fee Relief™. Monthly Maintenance Fee. $ or $; Waive the. How Do I Dispute an Account on My ChexSystems Report - Michigan Credit Reporting Lawyer. banks who have ruined your credit. How We Can Help You. No. Banks that offer Second Chance Checking will generally check ChexSystems. in Mechanical Engineering from the University of Michigan, and an MBA from the. Through the Michigan Open Account Coalition, participating banks and credit unions are offering certified low- or no-cost accounts to help Michiganders get. Have you been denied a bank account? LetMeBank provides extensive lists of banks that offer Non-ChexSystems & Second Chance checking accounts across the. Free List of Non ChexSystems Banks ; First State Bank, Michigan, v-y.site ; First State Bank, Kansas, v-y.site ; First State Bank of Mendota, Illinois.

All "Banks With Non Chexsystems" results in San Francisco, California - August · SF Fire Credit Union · Stanford Federal Credit Union · Charles Schwab. No cash transactions. | Get Directions · Eaton Rapids | Independent Bank. Branch Location. Contact Information. A: S. Michigan Road Eaton Rapids, MI No monthly service charge for electronic transactions (via Online Banking and at CASE-owned ATMs). Current Rates and Fees for Checking Accounts Fees are subject. Rewards Checking has no minimum balance required to open an account Unpaid bank fees and bounced checks can result in a negative file on ChexSystems. I doubt this is a comprehensive list, but it's the list I came up with while researching a "second chance" or "no ChexSystems" account for a. Foundation Checking. Access the way you want, with no overdraft fees. Everything you need in a checking account to focus on building towards your. You may also need to make a report of identity theft to your local police agency by calling their non-emergency number. Michigan law has made a victim's. Best Non-ChexSystems Banks & Credit Unions in Michigan v-y.site Not your state? No worries. All 50 states are listed on this page. Need a new MI deposit account? Look no further than Adventure Credit Union's free high yield checking account. Open an account to start earning interest. Chexsystems Repair, LLC. 43 To se mi líbí. Owned and operated by banking industry professionals. Get an FDIC insured REAL bank account today regardless. Discover the top banks that don't use ChexSystems for a fresh financial start. Explore your banking options without restrictions. Offers free advice and solutions for consumers seeking help with ChexSystems. v-y.site also provides a free list of Non-ChexSystems Banks. Michigan, North Carolina, Ohio, South Carolina, Tennessee, or West Virginia What's the Difference Between No ChexSystems Banks and Second Chance Banks? No minimum balance requirement · Zero monthly maintenance fees when you enroll in e-statements · Round Up with Flagstar lets you save the change whenever you use. Have you received a copy of your consumer disclosure report from ChexSystems? Yes. No. Personal Details. First Name *. Michigan First Credit Union offers a variety of personal and business banking services including accounts, loans, investments and more. Explore online. Discover Flagstar Ready Checking: Open a bank account with no deposit required and enjoy added perks, and no-fee checking with e-statements. On August 28, all MI branches will be closing at 12pm EST and MN branches will be closing at 11am CST for an All Employees Meeting. Normal business hours. You'll also be refunded up to $25/month in non-Vibe ATM fees on qualifying months. All new accounts are subject to ChexSystems and/or standard credit check. Choosing Between Non-ChexSystems Checking and Second Chance Checking. If you Massachusetts · Michigan · Minnesota · Mississippi · Missouri · Montana.

Personal Loan Percentage Calculator

loan above to the total amount of your current debt. What's a good interest rate for a personal loan? Personal loan interest rates range from 6% to Annual interest rate for this loan. Interest is calculated monthly on Personal Loan · Personal Loans · Student Loan · Student Loans · Debt Consolidation. Use our personal loan calculator to estimate monthly payments for a Wells Fargo personal loan. This calculator will help you see how long it will take to pay off your personal loan using your loan's interest rate and the amount owed. Personal loans may be good solutions for many kinds of expenses. And because their interest rates are usually fixed, unlike credit cards, loan repayment amounts. IDFC FIRST Bank Personal Loans offers competitive interest rates and flexible repayment terms, making them an attractive option for borrowers. If you are unsure. Calculate the rate and payment of your personal loan with U.S. Bank's personal loan calculator. Learn what you could qualify for today! Personal Loan Payment Calculator ; Based on your borrowing amount of $5, ; and interest rate of % ; and term of 5 years. Use this calculator to determine your monthly payments and the total costs of your personal loan. loan above to the total amount of your current debt. What's a good interest rate for a personal loan? Personal loan interest rates range from 6% to Annual interest rate for this loan. Interest is calculated monthly on Personal Loan · Personal Loans · Student Loan · Student Loans · Debt Consolidation. Use our personal loan calculator to estimate monthly payments for a Wells Fargo personal loan. This calculator will help you see how long it will take to pay off your personal loan using your loan's interest rate and the amount owed. Personal loans may be good solutions for many kinds of expenses. And because their interest rates are usually fixed, unlike credit cards, loan repayment amounts. IDFC FIRST Bank Personal Loans offers competitive interest rates and flexible repayment terms, making them an attractive option for borrowers. If you are unsure. Calculate the rate and payment of your personal loan with U.S. Bank's personal loan calculator. Learn what you could qualify for today! Personal Loan Payment Calculator ; Based on your borrowing amount of $5, ; and interest rate of % ; and term of 5 years. Use this calculator to determine your monthly payments and the total costs of your personal loan.

Just select an amount ranging from Rs 50, to Rs 50,00,, set an approximate interest rate and loan tenure between 12 and 72 months. The Personal Loan EMI. r is the monthly interest rate which can be calculated by dividing the annual interest rate by It is generally expressed as a decimal. n is the total number. Our personal loan payment calculator makes it easy to estimate monthly payments based on loan amount, term and credit score. Research U.S. News' Best Debt Consolidation Loans as you evaluate personal loan lenders for the best fit. It is expressed as a percentage of the loan. Our personal loan calculator can estimate your interest and monthly payments for the terms you pick. See how Discover Personal Loans could help you. This tool helps you see how long it will take to pay off a personal loan using a loan's interest rate and the amount owed. A simple way to understand the finances of multi-purpose loans - personal loan EMI calculator. All you need to do – fill the loan amount, interest rate and. What is the average interest rate on a loan? · Average interest rates for personal loans · Average interest rates for student loans. Personal Loan EMI Calculator - Online Personal Loan EMI Calculator helps you to calculate your installment, interest payable of loan amount and tenure. To do so, the following formula is v-y.sitey Interest Rate = Interest Rate/12For Example, if the interest rate offered to you for your personal loan is 18%. If you're looking to take out a personal loan but aren't sure how much you can afford to borrow, this personal loan calculator can help you find the answer. You can calculate the monthly interest payment by dividing the annual interest rate by the loan term in months. Then, multiply that number by the loan balance. Our handy Personal Loan Calculator can help you calculate estimated monthly payments APR represents the annual cost of a loan as a percentage, which take. This simple loan calculator can help you see how different interest rates, loan terms and loan amounts can impact a monthly payment. A personal loan can be a. But generally speaking, a higher credit score and a shorter repayment term lead to a lower APR. We'll walk you through how to calculate monthly payments and. You can then change the loan amount, interest rate or repayment term to see how a different loan might be better or worse for your situation. Loan Amount. Some lenders may also charge a higher interest rate if you choose a longer term. How do I interpret my personal loan estimate results? Before you commit. Use the United Community Personal Loan and Line of Credit calculator to compare loan amounts, monthly payments and interest rates. Just enter three key inputs – loan amount, term and interest – and the calculator will automatically do the calculations for you. Increasing the interest rate. Annual interest rate for this loan. Interest is calculated monthly on Personal Loan · Personal Loans · Student Loan · Student Loans · Debt Consolidation.

Can You Start A Plumbing Business Without A License

Both licenses require proof of 4 years of experience as well as passing a business and trade exam. You must also show proof of a bond. Arkansas. You can acquire. Having gone through years of study and practical training, you'll want to make sure that you comply with the laws in your state so that you can grow your. Work you can do without a permit. NYC Administrative Code Section clarifies work exempt from permit. For example, replacing an existing plumbing. Plumbing Contractors must be licensed to legally operate a business. DOPL requires anyone who wants to be a Plumbing Contractor in Utah to take a hour Pre-. A non-plumbing/gas fitting business does not need a business license if it employs one or more licensed plumbers or gas fitters and the only work performed by. IDPH licenses approximately 8, plumbers and 2, apprentice plumbers. To obtain a license, individuals must pass a state licensing exam after working under. New York does not license plumbers at the state level, but city and county governments are required to do so to protect the health and safety of the population. Ohio doesn't require individual plumbers to have licenses. However, if you plan to work as a plumbing contractor, you'll need a license issued by the Ohio. Not more than one license and seal shall be issued to an individual and no If a licensed master plumber withdraws from a master plumbing business. Both licenses require proof of 4 years of experience as well as passing a business and trade exam. You must also show proof of a bond. Arkansas. You can acquire. Having gone through years of study and practical training, you'll want to make sure that you comply with the laws in your state so that you can grow your. Work you can do without a permit. NYC Administrative Code Section clarifies work exempt from permit. For example, replacing an existing plumbing. Plumbing Contractors must be licensed to legally operate a business. DOPL requires anyone who wants to be a Plumbing Contractor in Utah to take a hour Pre-. A non-plumbing/gas fitting business does not need a business license if it employs one or more licensed plumbers or gas fitters and the only work performed by. IDPH licenses approximately 8, plumbers and 2, apprentice plumbers. To obtain a license, individuals must pass a state licensing exam after working under. New York does not license plumbers at the state level, but city and county governments are required to do so to protect the health and safety of the population. Ohio doesn't require individual plumbers to have licenses. However, if you plan to work as a plumbing contractor, you'll need a license issued by the Ohio. Not more than one license and seal shall be issued to an individual and no If a licensed master plumber withdraws from a master plumbing business.

Sole Proprietorship: In this kind of business ownership, you operate your plumbing business without a specific business structure. Your assets, liabilities, and. example, if a shampoo sink or public restroom is to be installed for an in-home beauty salon? No, the homeowner may only install plumbing in a one-family. start your own business, you must meet the licensing requirements. This guide will provide you with all the important details to become a plumber in Alabama. You can perform plumbing work without a license only if: You are registered Were employed by a company licensed by DLI as a plumbing contractor or. If you are approved for the license you are required to be an officer/partner/sole proprietor of a business/company, and the business must have an office in New. Furthermore, all of the plumbers who work for the company must have either a Tradesman or a Journeyman license. Finally, the licensed plumbers can have. Who must be licensed as a contractor? Contractors, including subcontractors, specialty contractors, and persons engaged in the business of home improvement . General Partnerships: A written agreement signed by all partners and notarized, creating the general partnership. All listed partners must be licensed master. If a business is a corporation, at least one corporate officer must be a plumber licensed by the City of Chicago. What is required to obtain a plumbing. Project Requirements for Owner: Plumbing · Work you can do without a permit · When you only need to hire a Licensed Master Plumber and obtain a permit · When you. New York state requires you to register your business with the Department of State. Licensing for skilled trades is done at the city or county level. You will. A: Yes, you need to be a licensed plumber to start a plumbing business. It's important to have certain levels of education, experience, and certification to. What plumbing work can be done without a license? In Florida, unlicensed plumbers can repair broken pipes, unclog drains, and provide estimates. However, in. The first step to start your plumbing business is to earn your Florida contractors license by passing the exam and proving your experience and financial. To become a licensed contractor, candidates are required to pass the California plumbers exam and the business and law exam. Legally anyone can start a plumbing business, BUT you must have a certifier overseeing you and so without one, you run a huge risk. You can also work as a plumbing contractor and run your own business. To be an apprentice plumber, however, you do not need any certification. But if you want. You will need to enroll in a professional school of your preference. Regardless of the chosen route, becoming a licensed contractor will require fulfilling. A plumbing license is typically required, which might involve exams and apprenticeships. You may also need business licenses, permits for commercial vehicles. Yes, general contractors will need to have a bond for each, if operating as a general construction contractor and licensed plumbing contractor. Can those who.

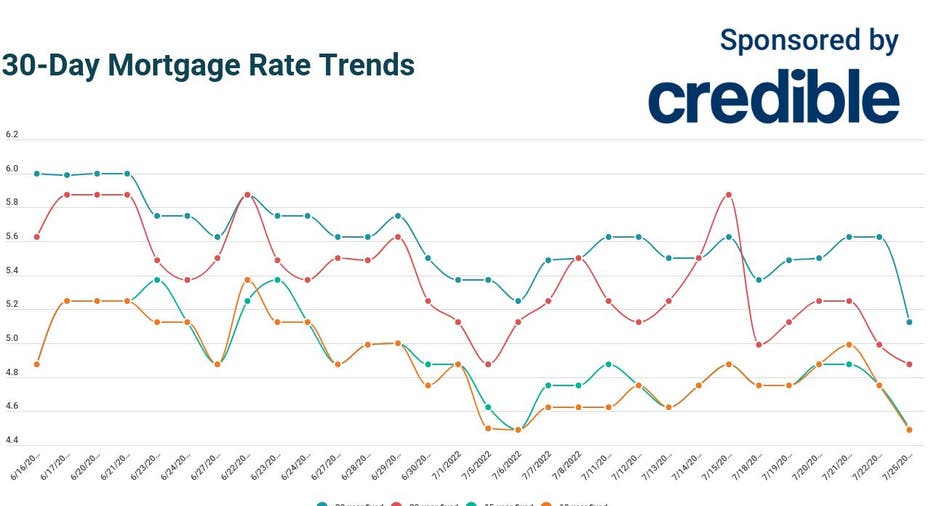

Current Va Refinance Rates 30 Year Fixed

Year Fixed-Rate VA. Interest%; APR%. More details for Year Fixed-Rate VA. Year Fixed Rate. Interest%; APR%. More details for Year. With an FHA year fixed mortgage, you can purchase a home with a lower down payment and flexible lending guidelines. You may also be able to streamline. The national average year VA refinance interest rate is %, down compared to last week's rate of %. See personalized rates. Mortgage. Purchase · Refinance · VA Loans. Home Equity. Home Equity Loans · HELOC · Cash-out Refinance. yr fixed VA. Rate. %. For today, Monday, September 09, , the national average year VA refinance interest rate is %, down compared to last week's rate of %. VA. As reported from a weekly survey of + lenders by Freddie Mac, the average mortgage interest rates decreased week over week — year fixed rates went. Check out current refinance rates for a year VA loan. These rates and APRs are current as of 08/27/ and may change at any time. They assume you have a. Rates as of Aug 29, ET. The interest rate above shows the option of purchasing discount points to lower a loan's interest rate and monthly payment. One. VA loan rates for August 29, ; year fixed VA ; year fixed VA, %, % ; Rates are provided by our partner network, and may not reflect the market. Year Fixed-Rate VA. Interest%; APR%. More details for Year Fixed-Rate VA. Year Fixed Rate. Interest%; APR%. More details for Year. With an FHA year fixed mortgage, you can purchase a home with a lower down payment and flexible lending guidelines. You may also be able to streamline. The national average year VA refinance interest rate is %, down compared to last week's rate of %. See personalized rates. Mortgage. Purchase · Refinance · VA Loans. Home Equity. Home Equity Loans · HELOC · Cash-out Refinance. yr fixed VA. Rate. %. For today, Monday, September 09, , the national average year VA refinance interest rate is %, down compared to last week's rate of %. VA. As reported from a weekly survey of + lenders by Freddie Mac, the average mortgage interest rates decreased week over week — year fixed rates went. Check out current refinance rates for a year VA loan. These rates and APRs are current as of 08/27/ and may change at any time. They assume you have a. Rates as of Aug 29, ET. The interest rate above shows the option of purchasing discount points to lower a loan's interest rate and monthly payment. One. VA loan rates for August 29, ; year fixed VA ; year fixed VA, %, % ; Rates are provided by our partner network, and may not reflect the market.

Current VA Mortgage Rates ; % · Year Jumbo · % · %. The year fixed VA mortgage rate on August 28, is down 4 basis points from the previous week's average rate of %. Additionally, the current national. See the mortgage rate a typical consumer might see in the most recent Primary Mortgage Market Survey, updated weekly. The PMMS is focused on conventional. VA funding fee under the CalVet/VA loan program, and one-year premium for disaster insurance included. Rates are subject to change. Actual payments will. Current Mortgage Refinancing Rates ; VA Loans · % · % ; VA Streamline (IRRRL) · % · % ; Military Choice · % · % ; Conventional Fixed Rate. Today's year fixed VA refinance loan rate stands at %. See more rates, including assumptions, in the table below. Personalize your rate ; 15 Year Fixed. $2, · % ; 20 Year Fixed. $1, · % ; 30 Year Fixed. $1, · %. For example, the VA home loan rate through Quicken Loans for a year fixed mortgage is currently %. Quicken Loans' conventional year fixed mortgage has. Today's VA Home Loan Rates ; %, %, % ; %, %, % ; %, %, % ; %, %, %. What are the current VA refinance rates? · Year IRRRL: Interest Rates are at %, and Annual Percentage Rates are at % · Year Cash-Out: Interest. National year fixed VA refinance rates go down to %. The current average year fixed VA refinance rate fell 8 basis points from % to % on. Find average mortgage rates for the 30 year VA fixed mortgage from Mortgage News Daily rate survey %, %. CURRENT MORTGAGE RATES. Today's Mortgage. Current VA IRRRL Rates ; Year Streamline (IRRRL) Refinance, %, % ; Year Streamline (IRRRL) Jumbo Refinance (Based on a $, loan amount). Average Mortgage Rates, Daily ; 30 Year Fixed. %. % ; 20 Year Fixed. %. % ; 15 Year Fixed. %. % ; 10 Year Fixed. %. %. Year Fixed Rate Veterans Affairs Mortgage Index (OBMMIVA30YF) ; ; ; ; ; View All. For example, in March , a typical year fixed mortgage (national) would come with an interest rate of %. In that same month, a VA loan on the same Current VA mortgage and refinance rates ; VA year 5/1 ARM mortgage purchase. %. % ; year fixed rate VA refinance. %. % ; year fixed rate. However, the APR on a year fixed loan with the company is % for a conventional and % for the VA option. USAA doesn't offer FHA or USDA loans. VA. VA loans: The annual percentage rate (APR) calculation assumes a $, fixed-term loan ($, base amount plus $6, VA funding fee) with no down payment. VA IRRRL rates. % interestSee note2; % APRSee note3. You can include all costs in a VA IRRRL. We'll cover your appraisal, title and funding fees.

Top Roth Ira

Conversely, if you're early in your career, a Roth IRA may help you stretch your future retirement savings. If years of compound growth result in significant. While a savings account can be used for any purchase, Roth IRAs are designed for saving for retirement. You contribute after-tax dollars and you can access your. Best Roth IRA Accounts for August · Our Top Picks · Fidelity Investments · Charles Schwab · Wealthfront · Betterment · M1 Finance · Vanguard · E*TRADE. The investments grow tax-deferred until retirement, at which point withdrawals are taxed as ordinary income. Roth IRA. In contrast to traditional IRAs, Roth IRA. The best Roth IRA accounts include Vanguard, Fidelity, Charles Schwab, Merrill Edge and E*TRADE. View our list of the best Roth IRAs to find one that is. Find the best Roth IRA account for you! · Traditional IRAs. - Make pre-tax contributions and pay taxes at retirement - Your funds grow tax-deferred · Certificate. Fidelity, Schwab, and Vanguard are all great options. pick whichever color you like best. Working with a qualified cross-border accountant and a cross-border financial advisor ensures you are on the right track, make the best decisions, and avoid. U.S. stock index funds. U.S. stock index funds are some of the best investments for a Roth IRA. S&P index funds are popular choices. “By doing the S&P, you'. Conversely, if you're early in your career, a Roth IRA may help you stretch your future retirement savings. If years of compound growth result in significant. While a savings account can be used for any purchase, Roth IRAs are designed for saving for retirement. You contribute after-tax dollars and you can access your. Best Roth IRA Accounts for August · Our Top Picks · Fidelity Investments · Charles Schwab · Wealthfront · Betterment · M1 Finance · Vanguard · E*TRADE. The investments grow tax-deferred until retirement, at which point withdrawals are taxed as ordinary income. Roth IRA. In contrast to traditional IRAs, Roth IRA. The best Roth IRA accounts include Vanguard, Fidelity, Charles Schwab, Merrill Edge and E*TRADE. View our list of the best Roth IRAs to find one that is. Find the best Roth IRA account for you! · Traditional IRAs. - Make pre-tax contributions and pay taxes at retirement - Your funds grow tax-deferred · Certificate. Fidelity, Schwab, and Vanguard are all great options. pick whichever color you like best. Working with a qualified cross-border accountant and a cross-border financial advisor ensures you are on the right track, make the best decisions, and avoid. U.S. stock index funds. U.S. stock index funds are some of the best investments for a Roth IRA. S&P index funds are popular choices. “By doing the S&P, you'.

Roth account to another employer's designated Roth account or into a Roth IRA? Are designated Roth accounts included when determining whether a plan is top. Selecting between a Roth IRA and mutual funds for retirement savings hinges on financial goals, investment strategy, and risk tolerance. Roth IRAs offer tax-. There is no such thing as a “best” Roth IRA because a Roth IRA is simply a tax structure not a product you and go an buy like a tube of. Best Roth IRA accounts of September · Charles Schwab · Wealthfront · Betterment · Fidelity Investments · Interactive Brokers · Fundrise · Schwab. Best Roth IRA accounts. The 10 best Roth IRAs. 1. Interactive Brokers Roth IRA; 2. Firstrade Roth IRA; 3. TD Ameritrade Roth IRA; 4. Charles Schwab Roth IRA; 5. Best Roth IRAs · Best for experienced investors: Charles Schwab® Roth IRA · Best for beginner investors eager to learn: Fidelity Investments Roth IRA · Best for. 8 Best Investments For Your Roth IRA · Index Funds · Exchange-Traded Funds (ETFs) · Mutual Funds · Dividend Stocks · Value Stocks · Crypto · REITs · Bonds. Many. 9 compelling Roth IRA benefits · 1. Money can grow tax-free; withdrawals are tax-free too · 2. There are no required minimum distributions · 3. Leave tax-free. Access a range of investments, including stocks, ETFs, mutual funds, and more. Best-in-class research. We offer industry-leading5 investment research to help. There are two common types of IRAs — traditional and Roth. Traditional or Roth IRA? If you're looking for an opportunity to save for retirement in a tax-. However, you should use Form to report amounts that you converted from a traditional IRA, a SEP, or Simple IRA to a Roth IRA. Return to Top. Distributions. Traditional IRAs offer the potential for tax deductibility in the present, while Roth IRAs are funded with after-tax dollars. Use this Roth IRA calculator to. Roth IRA. Roth IRA · Roth vs Traditional · Withdrawal Rules · Contribution Limits Here are answers to some top questions from investors like you: What is. Keep in mind part or all of the distribution may be subject to income tax. The good news is you have options. Learn more about Roth IRA conversions. A Roth IRA is an individual retirement account that you fund with after-tax dollars, and that offers tax-deferred growth and free withdrawals if certain. Consider Vanguard Total Stock Market Index Fund (VTSAX) or Vanguard Target Retirement Funds for your Roth IRA. These low-cost index funds offer. A Look at the Best · E*Trade — Get Up to $ for Opening a New IRA Account · TradeKing — Low Commissions and Fees · TD Ameritrade — Get Up to $ for a Rollover. Despite not offering an upfront tax deduction, a Roth IRA can offer flexibility to manage your taxes and spending in retirement because you can withdraw money. Roth accounts have been a popular way for Americans to generate tax-sheltered investment growth for more than 20 years, both as Roth IRAs and Roth (k)s. If you expect to be in a higher tax bracket when you retire compared to your current one, and you meet the income eligibility criteria, a Roth IRA might be a.

Canadian Amex Platinum

This offer is a benefit available to Basic American Express Canada Business Platinum Card Members. If you switch to a new Card product that is not eligible. The Platinum Card in Canada offers a number of elite travel benefits, and is Canada's premiere travel rewards Card. Discount flight bookings on Amex Travel (premium economy and up) · Airport transfer service (when booking business and up flights) · Fine Hotels. The American Express Platinum Card is the best credit card in Canada for travelers who want to earn a lot of rewards quickly. 71 Followers, 3 Following, 54 Posts - Amex Platinum user in Canada (@amexplat_canada) on Instagram: "Discover Amex Platinum service in Canada with me". Before this major upgrade, we were able to see airport lounges (Platinum benefits) with a few clicks and within the app. Now you are redirected to Safari. Take part in exclusive dining, outside and inside events including exhibitions, trips, experiences and more. Make the most of your Platinum Benefits. The Hotel Collection with Platinum · Up to $ USD hotel credit to use on amenities like dining, spa or other leisure facilities when charged to the room¹ · A. Celebrate your Membership and 40 years of the Platinum Card® with access to a complimentary 3rd night at + Fine Hotels + Resorts® and The Hotel Collection. This offer is a benefit available to Basic American Express Canada Business Platinum Card Members. If you switch to a new Card product that is not eligible. The Platinum Card in Canada offers a number of elite travel benefits, and is Canada's premiere travel rewards Card. Discount flight bookings on Amex Travel (premium economy and up) · Airport transfer service (when booking business and up flights) · Fine Hotels. The American Express Platinum Card is the best credit card in Canada for travelers who want to earn a lot of rewards quickly. 71 Followers, 3 Following, 54 Posts - Amex Platinum user in Canada (@amexplat_canada) on Instagram: "Discover Amex Platinum service in Canada with me". Before this major upgrade, we were able to see airport lounges (Platinum benefits) with a few clicks and within the app. Now you are redirected to Safari. Take part in exclusive dining, outside and inside events including exhibitions, trips, experiences and more. Make the most of your Platinum Benefits. The Hotel Collection with Platinum · Up to $ USD hotel credit to use on amenities like dining, spa or other leisure facilities when charged to the room¹ · A. Celebrate your Membership and 40 years of the Platinum Card® with access to a complimentary 3rd night at + Fine Hotels + Resorts® and The Hotel Collection.

With The Platinum Card® you are protected up to a maximum of $5 million per insured person (one of the highest dollar amounts for Canadian similar cards) for Platinum member requests in all instances. 3. Global Lounge Collection - Holders of the Platinum Card may access participating Canadian and International. The powerful backing of American Express. Find a Card that meets your needs - Rewards, Travel, Cash Back. Apply Now or Login to your Account. American Express, one of the top credit card companies in Canada, offers Platinum rewards: All Platinum American Express credit card holders can. Explore a wide range of curated services and offers in the home of American Express Membership Rewards. Earn points and spend at your leisure. American Express Platinum Card · Scotiabank Platinum American Express · TD Aeroplan Visa Infinite Privilege · RBC Avion Visa Infinite Privilege · RBC Ascend World. The Platinum Card · The Cobalt Card · The Gold Rewards Card · The American Express Amex Bank of Canada, P.O. Box , Station F, Toronto, ON M1W 3W7. Earn up to , Membership Rewards® points 1 – that's up to $1, in value. 2. Redefine what's possible for the way you live your life, with Platinum. Apply. Before this major upgrade, we were able to see airport lounges (Platinum benefits) with a few clicks and within the app. Now you are redirected to Safari. The American Express Platinum Card is the best credit card in Canada for travelers who want to earn a lot of rewards quickly. Terms & Conditions. 1. Member extras - Various offers will be available to Platinum Cardmembers. These offers will be communicated by email and other select. Access to a Pearson Priority Lane is available to eligible Canadian Cardmembers and companions travelling on the same itinerary. The eligible Cardmember can. Earn up to 6X the Scene+ points on every $1 CAD you spend in Canada on eligible grocery, dining, and entertainment purchases. The only major bank that saves you. For Canadian Amex Platinum, Business Platinum, and Centurion card holders, the guest policy is very straightforward and involves complimentary guest access. This group is about Canadians who owns American Express Platinum. Discussing/sharing perks, tips, tricks, and experiences with having the card. AMEX Platinum travel agent, you will get a $ rebate once a year. One advantage for the American card - no foreign currency transaction fee; the Canadian. American Express Canada offers a $ Annual Credit for travel booked through American Express Travel with the Platinum Card. This may be: A flight; A hotel; A. Canadian Cards ; 1) American Express® Aeroplan® Reserve Card. 1) ; 2) American Express Cobalt® Card. 2) ; 3) The Platinum Card®. 3) ; 4) Marriott Bonvoy®. Get cash back rebates when you start at Great Canadian Rebates. Save more money shopping for sales, deals and coupon codes. Earning Rewards · 2 points per $1 spent on dining and food delivery purchases in Canada. · 2 points per $1 spent on travel. · 1 point per $1 spent on all other.

What Is The Best Savings Bank

U.S. News' picks for the best high-interest-rate savings accounts with low minimums. The national average annual percentage yield for savings accounts is %. Renew the CD at a term and rate that is best for you, Interest Rates and APYs for all checking and savings accounts are variable and can be changed by the. The best high-yield savings account is UFB Portfolio Savings, earning the top rating of stars in our study. The account yields Up to % and doesn't. What should I consider when comparing savings accounts? · Interest rate vs access – most easy-access accounts offer a lower interest rate than other savings. American Savings Bank Hawaii offers consumer and business banking services including checking, savings, CDs, mortgages, loans and lines, and online banking. US News carefully evaluated over 80 banks and credit unions. Find the right bank for your needs, from large national institutions to online-only savings banks. My Banking Direct High Yield Savings.: Best for high APY · Varo Savings Account.: Best for automated savings tools · UFB Direct High Yield Savings · EverBank. A savings account with high interest offered through Raisin is a great alternative to the standard savings account you may get through a local brick-and-mortar. The Fortune Recommends team evaluated more than 60 high-yield savings accounts to find you the top picks. U.S. News' picks for the best high-interest-rate savings accounts with low minimums. The national average annual percentage yield for savings accounts is %. Renew the CD at a term and rate that is best for you, Interest Rates and APYs for all checking and savings accounts are variable and can be changed by the. The best high-yield savings account is UFB Portfolio Savings, earning the top rating of stars in our study. The account yields Up to % and doesn't. What should I consider when comparing savings accounts? · Interest rate vs access – most easy-access accounts offer a lower interest rate than other savings. American Savings Bank Hawaii offers consumer and business banking services including checking, savings, CDs, mortgages, loans and lines, and online banking. US News carefully evaluated over 80 banks and credit unions. Find the right bank for your needs, from large national institutions to online-only savings banks. My Banking Direct High Yield Savings.: Best for high APY · Varo Savings Account.: Best for automated savings tools · UFB Direct High Yield Savings · EverBank. A savings account with high interest offered through Raisin is a great alternative to the standard savings account you may get through a local brick-and-mortar. The Fortune Recommends team evaluated more than 60 high-yield savings accounts to find you the top picks.

I use amex and discover savings. Capitol one is another I used to have. They're all at %. You can find higher if you Google high yield. v-y.site has many banks to pick from. Right now rates for HYSA are up to % and 3 month CDs are %. Access our Premier Savings account. With tiered interest, you'll get better rates the more you save. Savings accounts Savings for a sunny day. A house. Vacation. Tickets to a The best part? The benefits increase as your balances grow. Automatically. Best for earning a high APY: Western Alliance Bank High-Yield Savings Account · Best for account features: LendingClub® High-Yield Savings · Best for no minimum. With a money market account, you may be able to get a better interest rate than you would with a regular savings or checking account, while maintaining. High yield savings accounts can help you meet your financial goals. Yet you need to be aware of how much your bank is charging you, too. Territorial Savings Bank Hawaii has multiple account options to choose from, all with access to online banking. Set up your savings account today. Compare WalletHub's editor's picks for the best savings accounts of, chosen from + offers. Let your money grow with the best savings account. High-Rate Savings Account Features. Bank anytime, anywhere with Alliant Mobile and Online Banking; Earn our best rate on all of your money with only a $ Marcus by Goldman Sachs High-Yield Saving Accounts would be my pick over Ally (I've had accounts at both). Just opened an account at Marcus. UFB Direct's savings account rivals competitors in rate, with a % APY. With no minimum deposit requirement and zero monthly fees, this account could be a. Review Bank of America's interest rates and annual percentage yields (APYs) for checking, savings, CD and IRA accounts specific to your area. Banner's Best is our highest earning savings account and features unlimited ATM withdrawals and overdraft protection. Check your local rates before opening an account. Open an Elite Money Market Account. Traditional savings accounts. Standard Savings Account. Best for. First. It's not easy to find savings accounts that pay interest rates up to 5%, but they do exist. Here's how to find the best savings accounts that pay up to 5%. Learn about the benefits of a Chase savings account online. Compare Chase savings accounts and select the one that best suits your needs. Visit Citizens to compare savings accounts and choose the best for your goals. From CDs to MMAs and general savings accounts, Citizens offers a variety of. Easy ways to save. Have a checking account with us, too? Enroll to round up debit card purchases and transfer the difference to savings automatically. Another great option. Great APY, no maintenance fees, or minimum balances—you can't go wrong with a Barclays online savings account.

Best Savings Account For Saving For A House

Summary of Best High-Yield Savings Accounts of ; Varo Savings Account, % to % APY, Need Help Saving More, $0 ; TAB Bank Logo TAB Bank High Yield. Union Savings Bank is a local community bank dedicated to excellent service for customers and communities. Visit our local banks in Connecticut. For those planning to purchase a home within the next 3 years, Fidelity suggests holding down payment cash in checking, regular savings, or high-yield savings. Step 2: Boost the interest you earn · 1. Bank accounts. Pay higher rates than standard savings & offer easy-access, though usually have low limits on how much. Whether you choose a certificate, money market or even a standard savings account, with Navy Federal's terrific rates, you'll earn more and save more. Open a separate savings account: As well as offering you a competitive interest rate, having a separate account to save for your deposit reduces the temptation. While having a large deposit gives you the best chance of How much do you need to save? Start saving for a deposit; Managing your savings account. UFB Direct is an online division of FDIC-insured Axos Bank. Its high-yield savings account pays an excellent % APY. There is no monthly fee, no minimum. If you want to buy a house in the next few years, you may wish to save for a home in a variety of accounts to get the best return possible. Citizens offers a. Summary of Best High-Yield Savings Accounts of ; Varo Savings Account, % to % APY, Need Help Saving More, $0 ; TAB Bank Logo TAB Bank High Yield. Union Savings Bank is a local community bank dedicated to excellent service for customers and communities. Visit our local banks in Connecticut. For those planning to purchase a home within the next 3 years, Fidelity suggests holding down payment cash in checking, regular savings, or high-yield savings. Step 2: Boost the interest you earn · 1. Bank accounts. Pay higher rates than standard savings & offer easy-access, though usually have low limits on how much. Whether you choose a certificate, money market or even a standard savings account, with Navy Federal's terrific rates, you'll earn more and save more. Open a separate savings account: As well as offering you a competitive interest rate, having a separate account to save for your deposit reduces the temptation. While having a large deposit gives you the best chance of How much do you need to save? Start saving for a deposit; Managing your savings account. UFB Direct is an online division of FDIC-insured Axos Bank. Its high-yield savings account pays an excellent % APY. There is no monthly fee, no minimum. If you want to buy a house in the next few years, you may wish to save for a home in a variety of accounts to get the best return possible. Citizens offers a.

First Home Super Saver Scheme The First Home Super Saver Scheme (FHSSS) lets first home buyers save a deposit through their super. You apply to withdraw a. There are a bunch of different tax-advantaged accounts that you can use to squirrel that down payment money away a little faster. First Home Savings Accounts . Decide what percentage of the home price you need to put away for a down payment and save consistently in a high-yield savings account. Your time frame for this. American Savings Bank Hawaii offers consumer and business banking services including checking, savings, CDs, mortgages, loans and lines, and online banking. Fortune Recommends: UFB Direct offers a high-yield savings account with a % APY along with no minimum opening deposits or monthly maintenance fees. Since. Find the right savings account to fit your financial goals, whether you're saving for a house or the holidays. Compare & find the best account for you. The UFB Portfolio Savings account has a strong APY at %, which is the highest rate on our. Stash your home down payment in a high APY account—our list of the best high-yield savings accounts can help. If you need to consolidate high-interest debt. And our current annual percentage yield (APY) of %* is over ten times the national bank savings average.1 Join us and start saving today. New Member Savings. Best savings account rates · UFB Direct — % APY, no minimum deposit to open · Bread Savings — % APY, $ minimum deposit to open · Bask Bank — % APY. TD High Interest Savings Account A place to put away the money you've saved · Tax-Free Savings Account There is a range of TFSAs that can help you save for short. Fixed term savings accounts – give a fixed interest rate when you save money for a set period of time. They can give you a predictable return on your money, but. Compare Chase savings accounts and select the one that best suits your needs Autosave. It's easy to save when linked to a Chase checking v-y.site Property Tax · Collections · Get Help · Revenue Online. Search this site. Submit What if I have a joint First-time Home Buyer Saving Account and I want to. High-yield savings accounts offer much higher annual percentage yields than traditional saving accounts, sometimes 10 times greater than the national average. The Small Business Bank Business High Yield Savings comes with % APY and a $0 minimum deposit requirement. Also, with no monthly fees, it's one of the best. savings club for kids ages 12 and under. Let's save together! Join Dollar's Savings Club and you will receive: Dollar's dog house bank; Coloring and activity. If you're hoping to put this down payment on a home within the next 5 years or so, any bank savings account, or CD, should work well for you. Many customers take these considerations into account when choosing an institution to bank with. Select a product and save. What do the best savings.

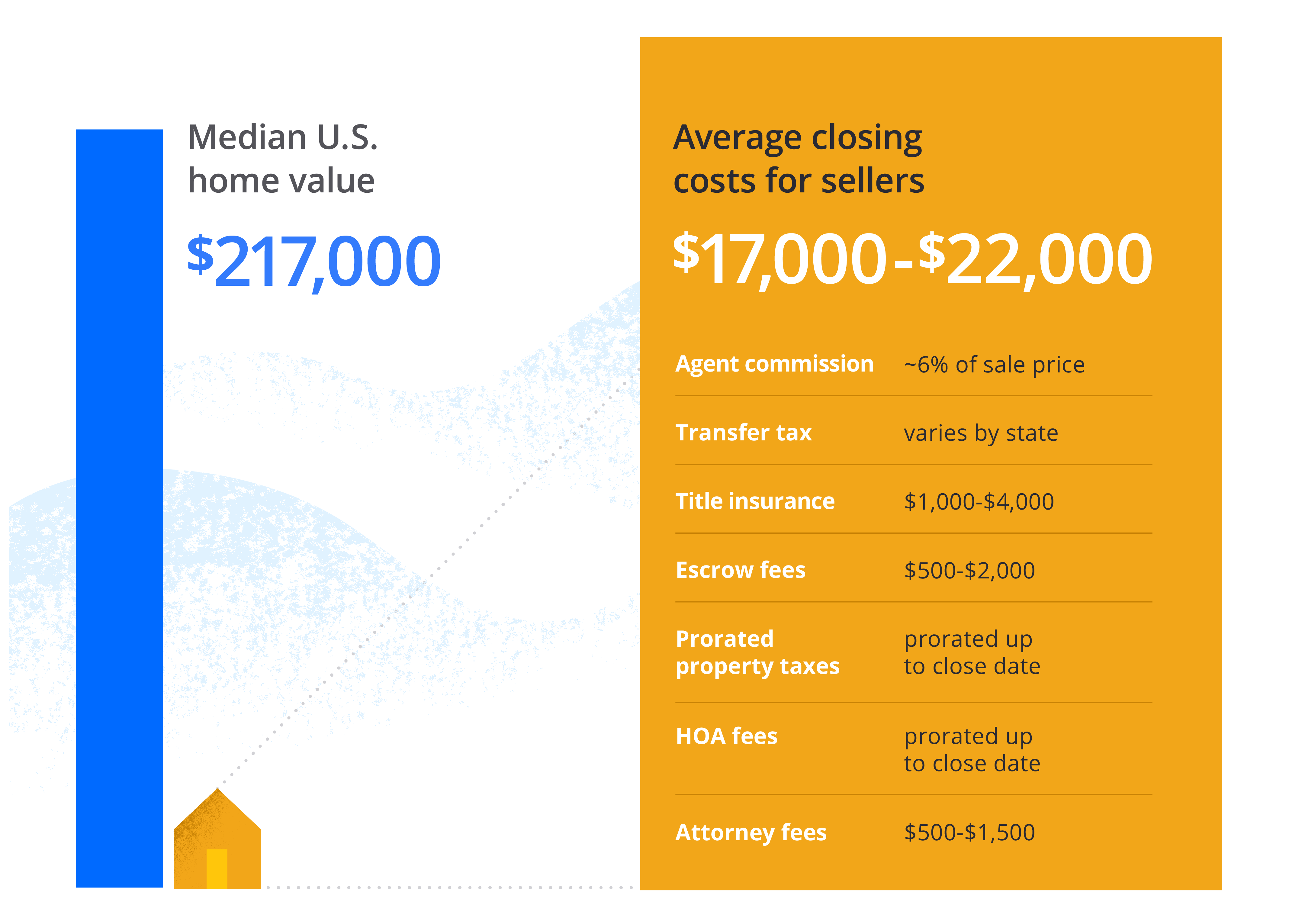

Whats The Average Cost Of A House

Click Here for Recent New Home Sales Prices -. - Click Here for A New Homes Price Chart -. Date (Month), Median Price (USD), Average Price (USD). When it comes to building a house there are many components that go into the total price. While at present in the US the national average cost to build a 1, The Zillow Home Value Index, which measures only the middle price tiers of homes, sets the cost of a typical home in the United States at $, Home values. After you buy your home, the one-time expenses are over, but the regular costs of owning a home have just begun. The average homeowner spends between $1, and. what is intrinsically a supply-side problem. Build more homes and/or make it more difficult for incumbents to hoard housing stock. Until CA. As of January , home prices in the US increased by % compared to last year. The median price is $, Building a Home. How much would it cost to. The average price for a constant-quality unit is derived from a set of statistical models relating sales price to selected standard physical characteristics of. There are homes for sale in New York, Kings County with a median price of $, which is an increase of % since last year. See more real estate. According to the National Association of Realtors, the median sales price of existing single-family homes in the United States was $, in April , an. Click Here for Recent New Home Sales Prices -. - Click Here for A New Homes Price Chart -. Date (Month), Median Price (USD), Average Price (USD). When it comes to building a house there are many components that go into the total price. While at present in the US the national average cost to build a 1, The Zillow Home Value Index, which measures only the middle price tiers of homes, sets the cost of a typical home in the United States at $, Home values. After you buy your home, the one-time expenses are over, but the regular costs of owning a home have just begun. The average homeowner spends between $1, and. what is intrinsically a supply-side problem. Build more homes and/or make it more difficult for incumbents to hoard housing stock. Until CA. As of January , home prices in the US increased by % compared to last year. The median price is $, Building a Home. How much would it cost to. The average price for a constant-quality unit is derived from a set of statistical models relating sales price to selected standard physical characteristics of. There are homes for sale in New York, Kings County with a median price of $, which is an increase of % since last year. See more real estate. According to the National Association of Realtors, the median sales price of existing single-family homes in the United States was $, in April , an.

YoY growth data is updated quarterly, available from Mar to Jun , with an average growth rate of %. House price data reached an all-time high of. The median existing-home price for all housing types in the US reached $, in July Single Family Home Prices in the United States averaged. Depending on the state you call home, the typical three-bedroom house can range from the mid-to-high $K to about $K. That's why GOBankingRates compiled a. List U.S. states and D.C. by median home price ; 1. Hawaii, $, ; 2. California, $, ; —. District of Columbia, $, ; 3. Massachusetts, $, According to Zillow the median home price is $, In a country of + million people and million homes sales price would probably. cost of building What Is the Price of a Home in the U.S.? As of Nov. (latest information), the average price of a home in the U.S. is $, The average cost to build a house in California is $, to $1,,, not including the cost of land or site prep. New home construction costs in. In August , New York home prices were down % compared to last year, selling for a median price of $K. On average, homes in New York sell after How much are average utilities for a house? · Electricity: $ · Natural gas: $ · Water: $ · Trash/Recycling: $ · Internet: $ · Cable: $ If you want to sell your home, you should know the process isn't free. The national average cost to sell a house is $33,; most homeowners can expect to. In addition, I'd be much more interested in the median price than the mean price. High end multimillion dollar houses would throw this off in. According to the National Association of Realtors, the median sales price of existing single-family homes in the United States was $, in April , an. How much does a Bozeman home cost? What is the average price for a house in Bozeman? What's the median cost for Bozeman homes? Find a local contractor to build your single-family home ; National average cost. $, ; Average range. $, to $, ; Low-end. $, ; High-end. Home values in Los Angeles, CA · $M Median listing home price · $ Median listing home price/Sq ft · $M Median sold home price. What is the median sale price and median price per sq ft in New York City? As of July, the median home sale price in New York City was $K. It costs the average American $, to be a homeowner for the average occupancy period of one home ( years). Hawaiians spend the most ($1,, over. Average monthly spending on housing: $2, (7% increase) Housing is by far the largest expense for Americans. Monthly housing expenses in averaged. The average home price was $, ($, in dollars). The COVID pandemic led many people to relocate or find new housing situations, which caused. The direction and pace at which home prices are changing are indicators of the strength of the housing market andwhether homes are becoming more or less.

1 2 3 4 5 6 7